BlackRock: A Buy Once More for This Outstanding Dividend Growth Stock (Rating Upgrade)

BlackRock assets under management ended the first quarter at an all-time high, helped by the general market gain. The top asset manager in the world beat analyst expectations in Q1 for both revenue and non-GAAP diluted EPS. S&P has assigned BlackRock an AA- credit rating with a stable outlook. The asset manager’s stock may be valued 2% less than fair value. BlackRock may be well-positioned to provide strong overall returns in the years to come.

Riding the Waves of Capitalism: A Study of BlackRock’s Growth Potential and Market Resilience

There is no assurance that the stock market will rise in any given year. It might potentially occur in two or even three years in a row (as it did from 2000 to 2002).

Thankfully, capitalism’s genius lies in the fact that markets cannot be maintained at a low level indefinitely. It is extremely improbable that markets will fall for two years in a row, especially outside of the tech boom. Of the twenty-four years this century has been lived through, sixteen have seen increases in the S&P 500 index, or SP500. The S&P recovered ferociously in 2023, climbing 24%, following a 19% correction in 2022. Over the course of 2024, the S&P has increased by 9%.

Owning BlackRock (NYSE: BLK) is, in my opinion, one of the more straightforward ways to profit from American capitalism. Higher equities markets almost always contribute to an increase in the company’s managed assets, revenue, and profits over time.

BlackRock’s near-perfect credit rating and position as an industry leader were highlights when I last evaluated the company in January and gave it a hold rating. I wasn’t as convinced about the valuation at the time. I’ll be talking about BlackRock’s first-quarter operating results and valuation today, along with my reasoning for raising the stock back to a buy recommendation.

Dividend Kings Zen Research Terminal

Examining BlackRock’s Dividend Performance: A Quantitative Evaluation

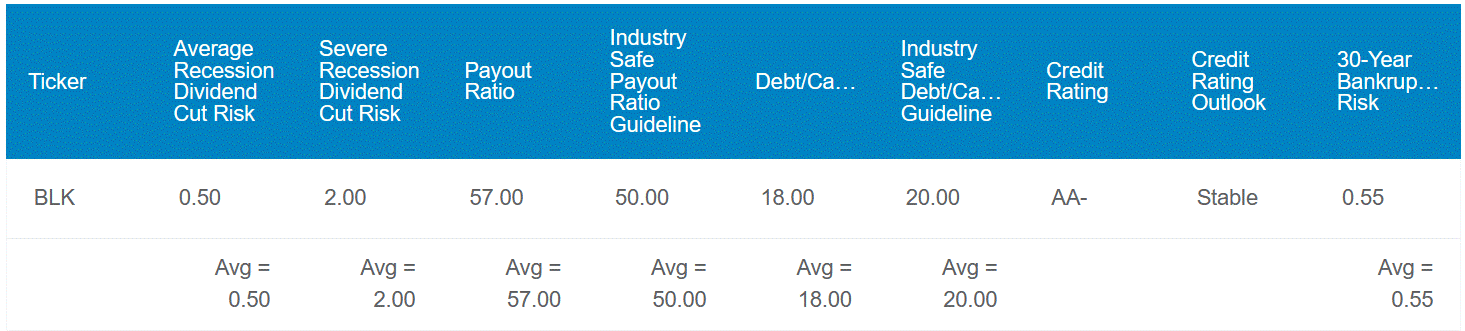

BlackRock’s projected dividend yield of 2.7% is noticeably less than the 3.6% norm for the finance sector. Seeking Alpha’s Quant System awards it a C- grade for projected dividend yield because of this. But BlackRock is a great dividend stock in every other way.

The company’s payout ratio of 57% EPS is rather higher than the industry standard of 50% EPS for asset managers, as requested by rating agencies. However, as I’ll go over in the section below on dividends, the payout ratio ought to quickly rise. This explains why BlackRock receives an A+ from the Quant System for dividend safety.

The company’s debt-to-capital ratio of 18% is superior to the industry average of 20% requested by rating agencies. Consequently, S&P has assigned BlackRock an AA- credit rating with a stable outlook. This implies that there is only a 0.55% chance that the asset manager will go bankrupt in the next 30 years. Stated differently, 181 out of 182 30-year simulations showed that BlackRock could continue as a going concern, meaning it would have enough resources to continue operating for the foreseeable future.

According to Zen Research Terminal’s projections, there is a 0.5% chance of a dividend decrease during the next recession. That risk would stay low at 2% even in the event of a severe recession in the future. These are the lowest values that can be achieved in the Zen Research Terminal under appropriate circumstances.

Dividend Kings Zen Research Terminal

Analyzing BlackRock’s Potential: A Value-Based Perspective for Investors

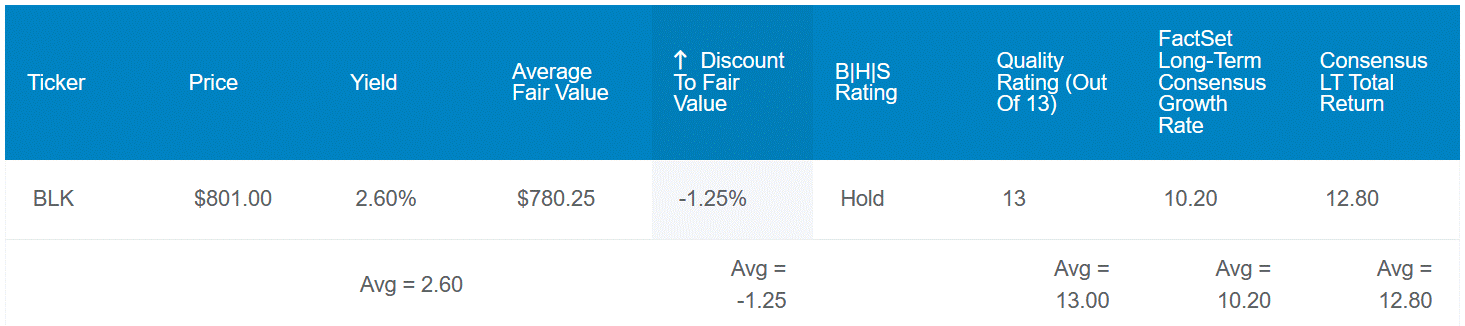

Since my last piece, BlackRock has dropped 4% while the S&P has surged 7% higher. Because of this, I find the stock to be intriguing enough that, in the appropriate situation, I may consider buying it. Given BlackRock’s 2.7% five-year average dividend yield, a share could be worth $745. I believe this shows BlackRock is fairly valued because the company’s fundamentals remain as solid as they have been in recent years, if not somewhat better. The stock may be reasonably valued at $791 based on its 10-year typical P/E ratio of somewhat less than 20. This might result in a fair value of $767 per share in 2024.

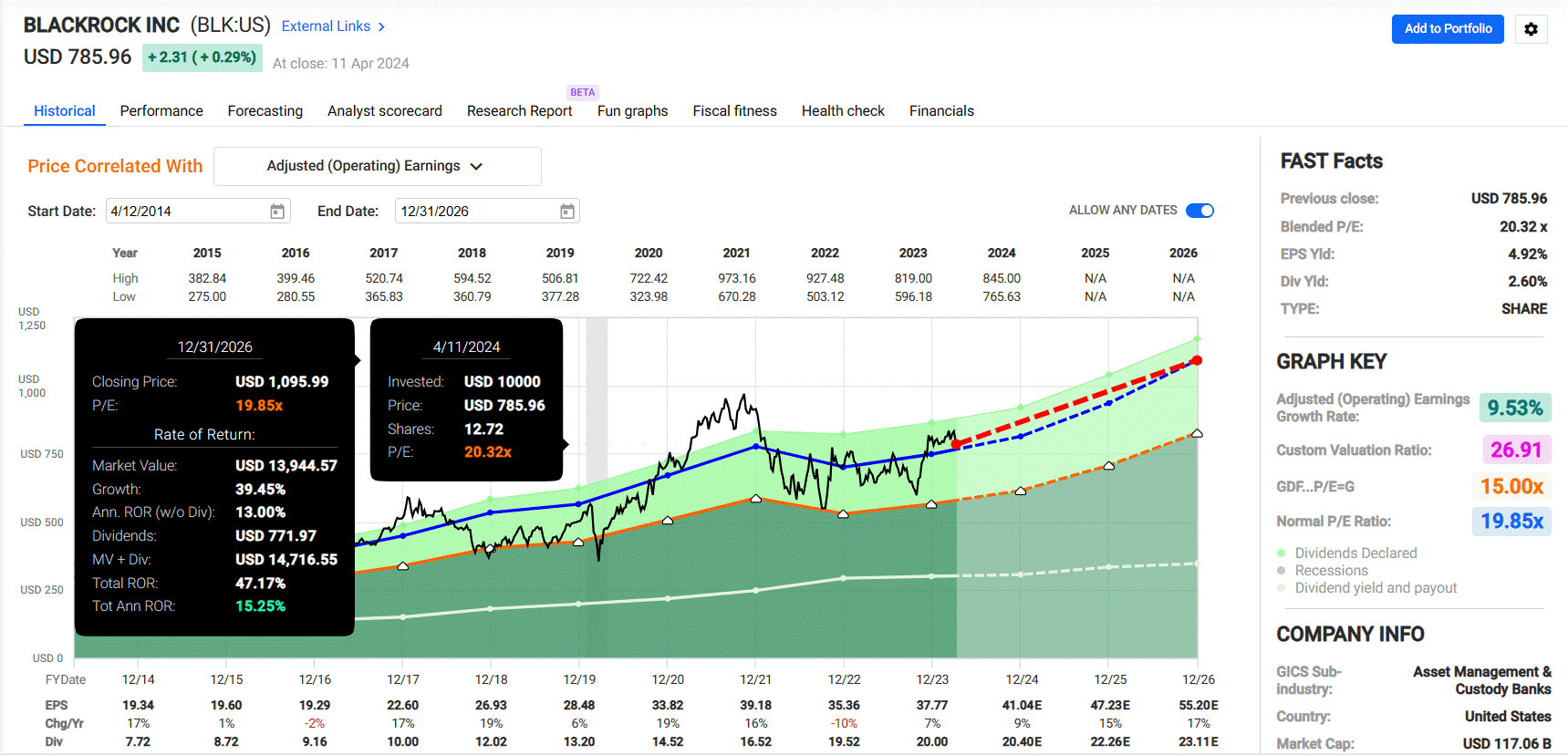

The fair value, based on the FAST Graphs earnings consensus for 2025, is $896 per share. A fair value of $813 per shares is obtained by averaging that with the five-year average dividend yield fair value. Including these reasonable estimates, BlackRock’s stock may be valued at $780 per share. That would mean that the current $768 share price (as of April 12, 2024) would be discounted by 2% to fair value.

Over the next ten years, BlackRock may see the following total returns if it can fulfil the growth consensus and go back to fair value:

2.7% yield + 10.2% FactSet Research annual growth consensus + a 0.2% annual valuation multiple expansion = 13.1% annual total return potential or a 242% 10-year cumulative total return against the 9.8% annual total return potential of the S&P or a 155% 10-year cumulative total return.

BlackRock Is Authoring a Comeback Story

BlackRock Q1 2024 Earnings Press Release The fair value, based on the FAST Graphs earnings consensus for 2025, is $896 per share. A fair value of $813 per shares is obtained by averaging that with the five-year average dividend yield fair value. Including these reasonable estimates, BlackRock’s stock may be valued at $780 per share. That would mean that the current $768 share price (as of April 12, 2024) would be discounted by 2% to fair value. Over the next ten years, BlackRock may see the following total returns if it can fulfil the growth consensus and go back to fair value:

Record Growth and Investor Confidence Are Driven by BlackRock Diverse Offerings

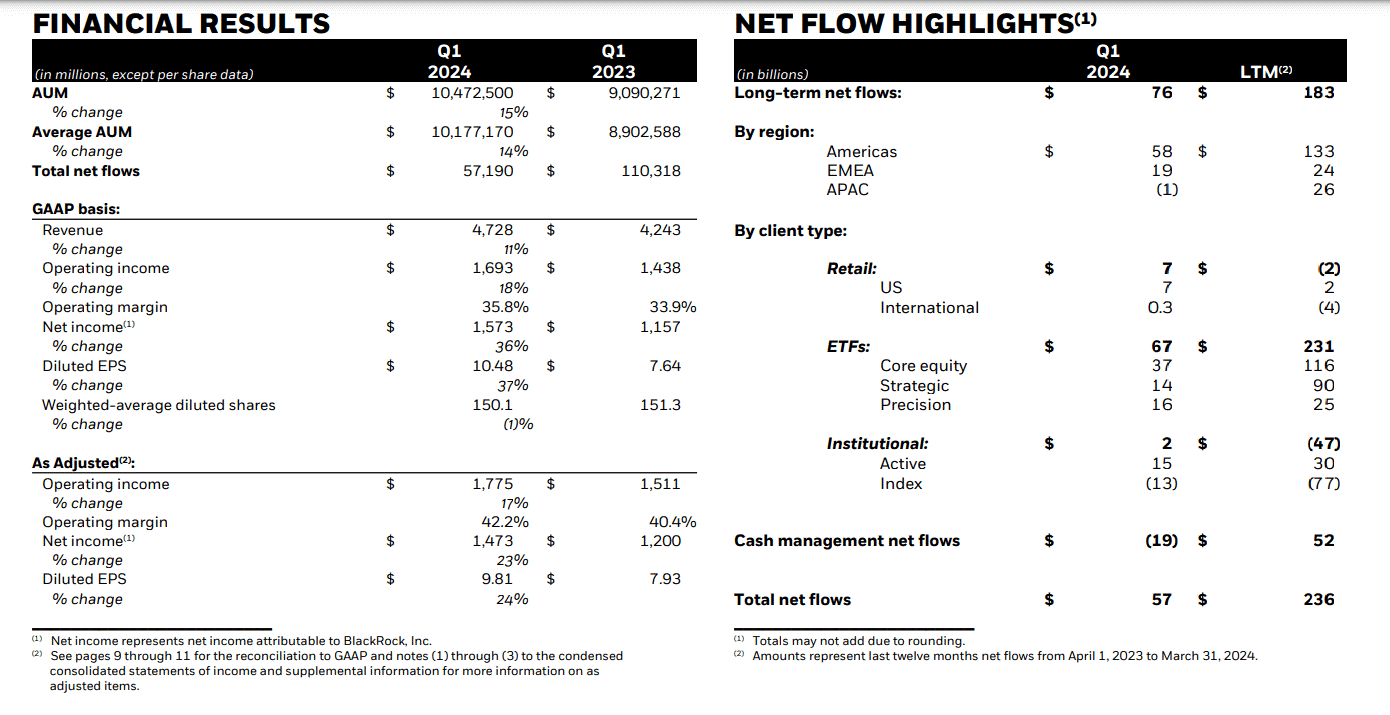

In addition, BlackRock enjoys an exceptional reputation as an asset manager with a wide range of financial solutions to suit the demands of almost every customer. The company provides fixed income/bond ETFs, value-oriented, growth-oriented, developing markets, and even a Bitcoin ETF (which, according to CEO Larry Fink’s opening remarks at the Q1 2024 Earnings Call, already has almost $20 billion in AUM). According to Fink, BlackRock has seen net inflows of $1.9 trillion in the previous five years alone because of this willingness to accommodate client preferences.

An additional $76 billion, or about 40% of the net inflows for the entire year 2023, arrived in the first quarter of this year. This suggests that investors are once more willing to part with their money, which is good news for BlackRock. The asset manager’s first quarter adjusted diluted EPS of $9.81 shot up 23.7% over the same time last year. This was $0.44 better than the analyst consensus, according to Seeking Alpha. BlackRock’s operating expenses grew at a slower rate during the quarter (8.2%) than revenue due to better operating efficiency. As a result, the non-GAAP net profit margin increased by 290 basis points to 31.2% for the quarter.

This, along with a 0.8% decrease in the number of diluted shares, is how BlackRock’s adjusted diluted EPS growth for the quarter significantly exceeded revenue growth. AUM, revenue, and net income should all rise in tandem with the company’s investment products as long as net inflows are sustained. For this reason, the adjusted diluted EPS growth predicted by FAST Graphs analyst consensus is 8.7% to $41.04 in 2024, 15.1% to $47.23 in 2025, and 16.9% to $55.20 in 2026.

In if that wasn’t sufficient, BlackRock is unquestionably in a strong financial position. During the first quarter, the company’s net interest/dividend income was $49 million. That amounted to nearly twice the $27 million in net interest and dividend income reported during the same time last year. BlackRock’s balance sheet is benefiting during a period when many businesses are being negatively impacted by rising interest rates (all information in this subhead, unless otherwise indicated or hyperlinked, was taken from BlackRock’s Q1 2024 Earnings Supplement and Press Release).

Expect Dividend Growth to Reaccelerate

Over the last five years, BlackRock’s quarterly dividend per share has grown at a compound annual growth rate of 9.1%, or $5.10. This is a cumulative 54.5% compound growth rate. Now, with the most recent 2% increase, dividend growth did encounter a difficulty.

But if the next climb wasn’t at least in the mid-to-upper single digits, I’d be shocked. BlackRock’s payout ratio for the year would be 49.7% if the current $41.04 adjusted diluted EPS analyst average for 2024 holds true. That is presuming that the dividend per share, which is now annualised at $20.40, is paid in 2024.

This would put the business in a position to produce dividend growth that is just slightly slower than the double-digit annual adjusted diluted EPS growth that is anticipated in 2025 and 2026. Nevertheless, dividend growth can be beneficial once more. In addition, the payout ratio has the potential to reach the usual range of low to mid-40%.

Risks To Consider

Despite BlackRock’s fundamental success, there are still dangers that might undermine the investing premise. One major risk is that, in the asset management business, results and reputation are the only factors that count. BlackRock has been doing the right thing by its stakeholders for almost 40 years. Its rise to prominence as the world’s most reputable asset manager can be attributed to this. However, if the business is unable to continue delivering, it may lose market share to rivals. The growth story can suffer from that.

A computer compromise could potentially harm BlackRock’s brand. Even while it seems improbable, a large-scale breach might have serious consequences. Client sensitive data and confidential information may be jeopardised. That might also seriously impair the company’s chances for future growth.

Our Previous Blog

50% more money is made by the top 20% of Urban Company partners than by entry-level IT positions.