iShares MSCI World Swap UCITS ETF (IWDS) Expanding Synthetic Range Launched by BlackRock

A worldwide equities ETF has been introduced by BlackRock, broadening its portfolio of synthetic investments.

With a total expense ratio (TER) of 0.20%, the iShares MSCI World Swap UCITS ETF (IWDS) is listed on Euronext Amsterdam.

IWDS is a market data provider that tracks the MSCI World Net TR index, which provides exposure to 1,480 stocks from 23 developed market nations. Under its unfunded swap approach, a counterparty exchanges a swap charge for the complete return of the index.

Since numerous parties are bidding for the swap contract, the ETF’s various swap counterparts, according to BlackRock, provide best performance while preventing overconcentration with a single counterparty.

Standards and Benefits of IWDS and Other Synthetic ETFs

Businesses included in IWDS’s replacement basket need to be listed on the MSCI World, their weighting cannot be greater than 5%, and the total number of shares in the basket cannot be greater than 100% of the financial security’s 30-day average daily trading volume (ADV). The swap basket does not include bank, dividend-paying, or corporate action shares. In terms of performance, synthetic exchange-traded funds (ETFs) like IWDS outperform physical ETFs when providing exposure to US stocks. Currently, the US is weighted 70% in IWDS. Since only non-dividend paying equities may be found in the ETF’s alternative basket, they are exempt from paying withholding tax on dividends.

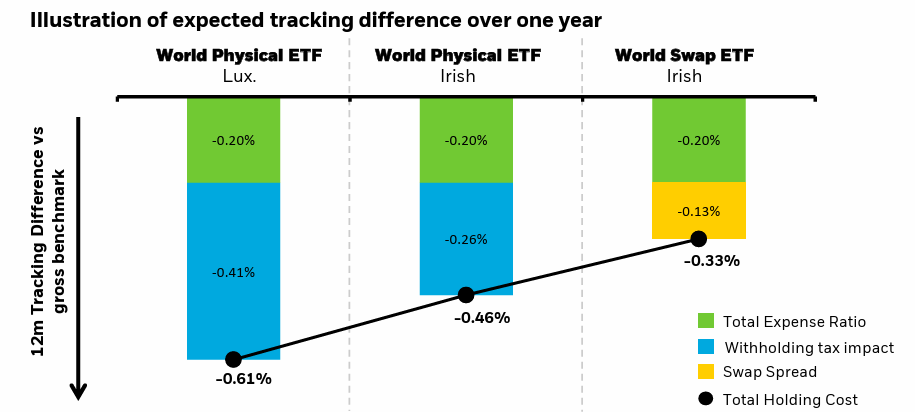

Tax Consequences and Monitoring Disparities: Evaluating Real and Synthetic Global ETFs

US equities dividends from physical ETFs based in Ireland are taxed at 15%, compared to 30% in other countries like Luxembourg.

Based on BlackRock, this means that a synthetic global ETF will yield a per-year tracking difference of 0.33% as opposed to 0.46% and 0.61% for physical ETFs based in Ireland and Luxembourg, respectively. BlackRock is the third opponent to introduce a synthetic global ETF, after Invesco and DWS. subsequently the $4.7 billion Invesco MSCI World UCITS ETF (MXWS), which has a TER of 0.19%, and the $6 billion Xtrackers MSCI World Swap UCITS ETF (XMWO), which has a fee of 0.45%, IWDS is the second-cheapest product available.

BlackRock’s Growth: Third Synthetic ETF Launches Signals Strategy Change

After the introduction of two US equities ETFs, the iShares MSCI USA Swap UCITS ETF (MUSA) and the iShares S&P 500 Swap UCITS ETF (I500), this is the third synthetic ETF offered by the largest asset manager in the world.

In terms of product structure, BlackRock, the largest asset manager in the world, has reversed course and decided to introduce synthetic ETFs in 2020.

At a meeting in New York after BlackRock acquired iShares from Barclays in 2009, CEO Larry Fink of BlackRock criticised SocGen and Lyxor, two competing European companies, for using it in synthetic exchange-traded funds. BlackRock only sold physical ETFs at the time.

Our Previous blog